Note: The information provided in this article is for informational purposes only and should not be considered financial advice. Investing in stocks carries risks, and it’s essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Table of Contents

Introduction

In this comprehensive analysis, we delve into the Lucid stock price predictions for 2024, 2025, 2026, 2027, and 2030, taking into account various factors that may influence its performance.

Lucid Group (NASDAQ: LCID) has emerged as a prominent player in the electric vehicle (EV) manufacturing industry. With its flagship vehicle, the Lucid Air, the company aims to challenge Tesla and establish its position in the luxury EV market. Investors and market enthusiasts have been closely monitoring Lucid’s stock performance, leading to numerous predictions and forecasts for the upcoming years.

Historical Overview of Lucid Group

Lucid Group, previously named Atieva, was established in 2007 by Bernard Tse, Sam Weng, and Peter Rawlinson. The company is based in Newark, California, and is renowned for its dedication to the advancement of superior electric vehicles.

In 2016, Lucid achieved a significant milestone with the introduction of the Lucid Air, an economical and eco-friendly electric car boasting an impressive range of 520 miles on a single charge. The Lucid Air received favorable feedback and attracted considerable interest within the electric vehicle market.

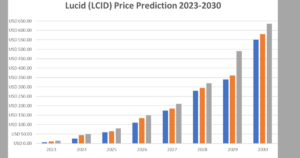

Lucid Stock Price Predictions: A Yearly Outlook

To understand the potential trajectory of Lucid’s stock price, let’s explore the predictions for each year:

Lucid Stock Price Predictions for 2024

According to industry analysts, Lucid’s stock price is expected to reach an average of $19 in 2024, with a potential range of $13 to $25. These forecasts consider several market variables, such as the demand for electric vehicles (EVs), competition within the industry, and Lucid’s financial achievements.

Lucid Stock Price Predictions for 2025

As we gaze into the future of 2025, the prediction indicates that Lucid’s stock will have an estimated price of $23, with a range spanning from $16 to $31. This forecast takes into account the expected expansion and promising prospects for Lucid in the electric vehicle (EV) market. Nevertheless, it is vital to bear in mind that stock prices are susceptible to fluctuations in the market and can be impacted by a variety of external elements.

Lucid Stock Price Predictions for 2026

The projected forecast for Lucid’s stock price in 2026 suggests that the average price will be $29 per share. This estimate includes a minimum price of $20 and a maximum price of $39. These predictions emphasize the potential for further growth and market expansion for Lucid, as the company strives to strengthen its position within the electric vehicle (EV) industry. Lucid’s stock price outlook indicates positive prospects for the future, signaling the company’s commitment to establishing itself as a leading player in the EV market.

Lucid Stock Price Predictions for 2027

As we gaze into the future, specifically to the year 2027, experts forecast that the mean estimate for Lucid’s stock price will be $72, with a potential range of $48 to $95. This prediction suggests that Lucid has the opportunity to experience substantial growth and gain greater recognition in the market. It is a testament to the company’s ongoing commitment to innovation and its ability to attract a larger portion of the market.

Lucid Stock Price Predictions for 2030

The projected average for Lucid’s stock price in 2030 is $72, with a range spanning from $48 to $95. These forecasts take into account the company’s potential for expansion, advancements in their products, and the expected state of the market. Nevertheless, it is crucial to acknowledge that long-term predictions are subject to a greater level of uncertainty, and market conditions can shift over time.

Current Market Scenario and Competitors

Lucid operates in a fiercely competitive electric vehicle (EV) market, where it faces strong competition from notable players such as Tesla, XPeng, NIO, and Ford. These competitors provide a range of EVs, catering to both luxury and mass-market segments, which presents a challenge for Lucid’s position within the industry. Lucid’s success in setting itself apart from the competition and securing a substantial market share will be pivotal in determining its stock performance. As the EV market continues to evolve, Lucid must find unique ways to differentiate itself and attract customers in order to thrive in this highly competitive landscape.

Growth Opportunities for Lucid

Lucid has identified a variety of growth prospects that have the potential to enhance its sales and market presence. These prospects encompass the introduction of fresh models, such as the Gravity SUV, the expansion into untapped markets like Europe and the Middle East, and the utilization of its cutting-edge EV technology. The successful execution of these growth strategies will play a pivotal role in determining Lucid’s stock performance.

Financial Performance and Risks

Lucid has demonstrated impressive growth in revenue, indicating a positive financial performance. However, the company has also experienced substantial net losses. The key to Lucid’s success lies in its capacity to expand production, control costs, and effectively navigate the competitive market. There are several risks associated with investing in Lucid’s stock, including potential delays in production, uncertain demand, concerns about high valuation, and intense competition. Before making any investment decisions, it is crucial for investors to thoroughly assess and consider these risks.

Key Factors to Watch

Investors who are considering investing in Lucid’s stock should pay close attention to a range of essential elements that can significantly influence its performance. These critical factors encompass operational measurements, the introduction of new products, efforts to expand into additional markets, advancements in technology, and any legal or regulatory changes. By staying well-informed about these variables, investors will be better equipped to make wise decisions based on the ever-changing dynamics of the electric vehicle industry.

Final Thoughts on Lucid Stock Price Prediction

In summary, Lucid’s stock offers investors both significant risks and potential rewards. The company’s ability to overcome production challenges, meet increasing demand, and differentiate itself in a competitive market will ultimately determine its success.

While there are predictions of potential growth in the stock price for the years 2024, 2025, 2026, 2027, and 2030, it is important for investors to approach Lucid with caution and conduct thorough research. Staying well-informed about the evolving electric vehicle (EV) landscape and making investment decisions based on careful analysis and risk assessment is crucial.

It is worth noting that investing in stocks entails risks, and seeking guidance from a financial advisor before making any investment decisions is advisable.

It is important to understand that the predictions and forecasts mentioned in this article are based on available information and various market factors. They should not be considered as guaranteed outcomes or financial advice.

Check more stock price prediction

Lucid Stock Price Predictions FAQS

What will Lucid stock price be in 2025?

Based on our analysis and forecast from Lucid Group, Inc., we predict that the price of LCID stock will reach $4.15 by the year 2025. This projection is derived from the average growth rate of the stock over the course of the last decade.

What is the prediction for Lucid in 2024?

Lucid, a company known for reducing the prices of its Air luxury electric sedans, has also provided a production forecast for 2024 that falls below Wall Street's projections. The company plans to manufacture 9,000 units this year, which is an increase from the 8,428 vehicles produced in 2023.

How much will Lucid stock be worth in 5 years?

Lucid's projected stock price for the year 2024 is anticipated to be approximately $19, with a potential fluctuation between $13 and $25. Moving forward to 2025, market forecasts predict an average price of $23, with a range spanning from $16 to $31.

How high will Lucid stock go up?

Over the past three months, a group of nine Wall Street analysts have provided their predictions on the price targets for Lucid Group. The average price target is estimated to be $5.00, with the highest forecast at $7.00 and the lowest at $1.00. This average price target suggests a 34.77% change from the current price of $3.71. These predictions serve as valuable insights for investors and market observers.

Welcome to the dynamic world of news, where information meets insight, and stories unfold with precision. Meet Shadab Ahmed, the adept author behind the enlightening narratives on Zilly News. With a keen eye for detail and a passion for delivering accurate, timely news, Shadab brings a fresh perspective to the digital news landscape.

2 thoughts on “Lucid Stock Price Predictions for 2024,2025,2026,2027,2030”